How to save energy: business case & financing

Read time: 6 minutes

Many energy efficiency projects will require capital investment in one form or another, but you shouldn’t consider this a barrier.

The return on investment (ROI) for many energy-saving measures is now very fast (if your energy costs have doubled, so have the potential savings from energy efficiency).

However, even measures with longer payback periods of a few years are still worth exploring. Energy costs are not currently forecast to return to pre-2021 levels this decade and cashflow-positive finance packages are now widely available.

Here are our tips for building a strong business case to take to your finance director or decision-maker:

You may have looked at projects in the past to change your lighting, replace inefficient equipment, or install solar PV on your rooftop, and decided at the time the ROI wasn’t good enough.

It’s now time to reappraise these projects. The fact that energy costs have rocketed upwards, combined with the significant reduction in the cost of green technologies in recent years, means the economics are now much more likely to stack up in your favour.

Take LED lighting, for example – one of the most popular capex measures to improve energy efficiency. Something in the region of a two-year payback was generally a safe assumption in the past, but now in most cases, it will pay back in less than a year.

Solar PV is another good example. A year or two ago, typical rooftop solar PV projects had around a 6-7-year payback (or 14-16% ROI). Today it’s significantly less; possibly as low as two years (50% ROI) for many businesses.

For businesses that use a lot of energy during the day, like manufacturers, the payback can sometimes be even better. One manufacturer in Bolton recently told us that they were looking at a payback of just 20 months, based on projected energy prices without the Energy Bill Relief Scheme.

Remember: energy prices will remain elevated for the foreseeable future so the goal is not just to reduce energy costs in the near-term, but the long-term as well.

When faced with the need to upgrade or replace equipment, choosing the lowest cost option always seems more attractive at the moment, especially when budgets are under pressure.

Don’t give in to that feeling. What you don’t see on that purchase price is the massive cost that is swallowed up by additional energy needed to run the asset over its lifetime compared to a more efficient alternative.

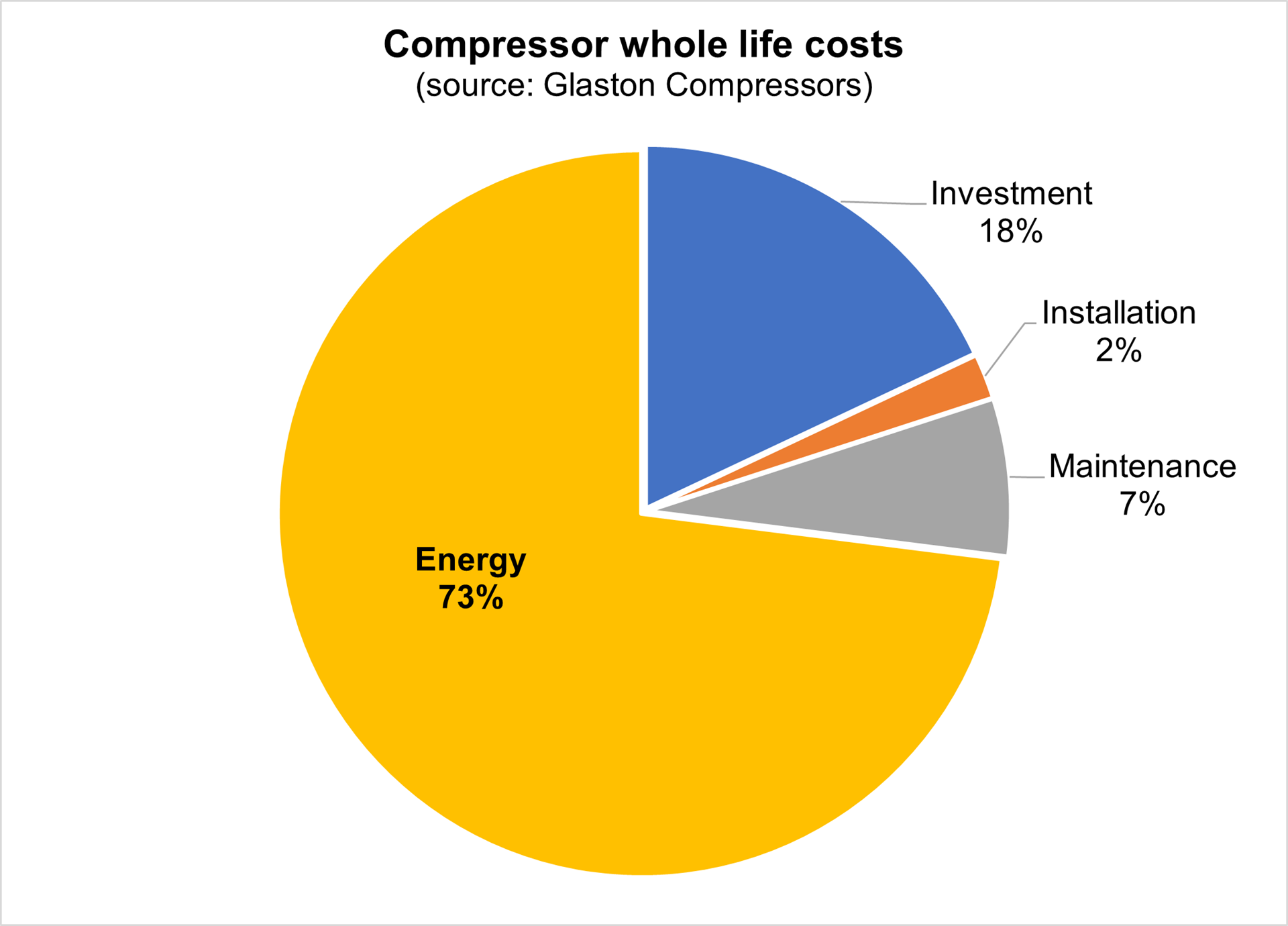

Instead of focusing on the initial upfront cost, build your business case based on whole-life costs by including the running costs in your calculations. For most types of equipment, particularly those with a long lifespan, the running costs will be far greater than the purchase price – as the image here of a typical compressor demonstrates (this breakdown is based on pre-crisis prices, so the energy component will be even higher today):

Watch a recording of our webinar, addressing the business case for decarbonisation.

The marginal cost difference of choosing the next or most efficient model will often pay for itself within a matter of weeks in lower energy consumption, so you get that initial additional outlay back incredibly quickly.

Always take a closer look at the energy label, which runs on a scale of A to G, for a general comparison of running costs.

Another way of getting a rough comparison between options is to take the product’s kilowatt rating (which should be provided in the technical specs) and multiply it by the number of hours it will be running for, which provides you with a kWh figure. You can then multiply this by the price you pay per kWh of electricity or gas for a good indication of running costs.

When preparing a business case to present to a decision-maker, it pays to take into account both the financial and non-financial benefits.

Decision makers are now much more likely to prick up their ears when they hear that an investment will save energy and pay back quickly, but that’s only the tip of the iceberg:

These are all examples of additional ammunition you can bring to decision-makers to persuade them of the business case.

The benefits you lean on most will depend on the person you’re talking to. If you’re speaking to your finance director, it makes sense to focus on cost savings, financial resilience and extended lifespan benefits.

If you’re speaking to a production manager or operations director, it may be more beneficial to focus on how the new equipment will make their life easier through improved reliability, reduced maintenance requirements and improved comfort and productivity.

If you’re speaking to a sales director or sustainability manager, you could focus more on the carbon footprint benefits.

The financing options available for energy efficiency investments will depend on the specific technology and the circumstances within your business. However, generally speaking, it can be more straightforward than you might think:

The important thing when weighing up your options is to make sure the monthly cost savings from the technology are higher than the cost of repayments (ideally by a 20-30% margin, to allow for variabilities in real-life performance). This will mean your investment is effectively ‘cashflow positive’ from day one, with that margin going straight into your pocket every month until the investment is paid off in full.

If you’re looking to install popular energy-saving technologies such as LED lighting or solar PV, bear in mind that they are now in very high demand and installers are extremely busy. For example, solar PV suppliers in Greater Manchester are already telling us that the commissioning process for solar panel systems is currently taking between 4-6 months.

Waiting lists are growing, so time is of the essence – especially if you are planning large energy investments.

Need support?

If you are seeking a trusted, local supplier for installing energy-saving technologies, use our online marketplace.

This blog was originally published on the Bee Net Zero website.

Read our series of blogs to help you reduce energy in your business.